The Global Orthopedic Implant Market: Growth Opportunities and Challenges

The global orthopedic implant market has become a cornerstone of modern medical technology. Driven by the rising prevalence of orthopedic conditions, expanding geriatric populations, and increasing road traffic accidents and sports injuries, the demand for surgical implants is experiencing remarkable growth.

At events like Pharmatech East Africa 2025, stakeholders will showcase cutting-edge implant solutions and forge strategic collaborations to shape the next generation of musculoskeletal care. With new frontiers in 3D printing, biomaterials, and robotic-assisted surgeries, the market offers vast opportunities for manufacturers, distributors, and investors alike.

Platforms such as the Pharmaceutical Exhibition Tanzania have been instrumental in highlighting the demand-supply gaps and emerging trends in African nations, driving interest in localized production and regional partnerships.

Global Market

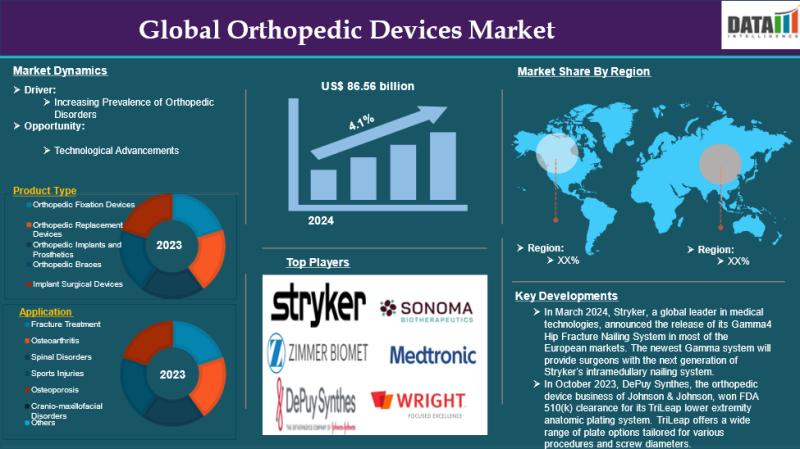

The following key drivers underpin the growth in the medical implant market:

- Rising cases of osteoporosis, arthritis, and degenerative joint disorders.

- Increasing number of orthopedic surgeries globally.

- Technological advancements in custom implants and minimally invasive procedures.

North America holds the largest market share due to its advanced healthcare infrastructure, high adoption of surgical procedures, and favorable reimbursement policies. However, Asia-Pacific and Middle Eastern regions are emerging rapidly, offering lucrative investment prospects.

Key Growth Opportunities in the Orthopedic Implant Sector

Emerging Markets-Untapped Potential in Africa and Asia: There is a surge in orthopedic conditions in low- and middle-income countries, primarily due to urbanization, poor ergonomics, and inadequate early interventions. Countries such as India, Kenya, Tanzania, and Indonesia are experiencing increased demand for trauma, spinal, and joint implants.

Key opportunity drivers include:

- Rising healthcare budgets and investments.

- Government initiatives to reduce medical imports by promoting local production.

- Growing private hospital chains and specialty orthopedic centers.

Companies can establish a significant footprint by tapping into these regions through local distributors, surgeon training programs, and affordable implant offerings.

Advancements in Biomaterials and Coatings: Materials such as PEEK (polyether ether ketone), titanium alloys, and bioresorbable polymers are revolutionizing the market. These materials offer superior biocompatibility, corrosion resistance, and long-term performance, reducing the need for revision surgeries.

Additionally, antibacterial coatings and hydroxyapatite surface treatments are becoming more prominent, particularly for elderly and diabetic patients prone to infections.

Digital Transformation and 3D Printing: Personalized implants via 3D printing are creating new possibilities in maxillofacial, cranial, and spinal reconstruction. With patient-specific geometries and rapid prototyping, 3D technology reduces surgical time and improves clinical outcomes.

Artificial intelligence and machine learning also enable predictive analytics in preoperative planning, ensuring optimal fit and load distribution of implants.

Significant Challenges Faced by the Industry

Regulatory Complexities: Surgical implants fall under Class II and III medical devices, subjecting them to stringent regulatory scrutiny. From the FDA’s 510(k) clearance in the U.S. to CE marking in the European Union, manufacturers must adhere to strict quality, safety, and performance standards.

Variations in regulatory frameworks across countries can delay product launches and increase compliance costs, especially for smaller companies.

High Cost of Implants and Surgeries: Implant costs can range from USD 1,000 to over USD 10,000, depending on the type and complexity. In emerging economies, where health insurance penetration is low, this becomes a barrier to access.

Efforts to develop cost-effective alternatives, especially generic implants, must be balanced against maintaining safety and efficacy.

Implant Failures and Litigation Risks: Failures due to loosening, wear, or infection can result in patient suffering and legal repercussions. High-profile litigations against implant companies have impacted brand trust and led to costly settlements.

This necessitates enhanced post-market surveillance, patient education, and continuous product improvement based on real-world evidence.

Segment-wise Analysis of Orthopedic Implants

Joint Reconstruction Implants: Hip and knee replacements dominate this category, with the aging population in the U.S., Japan, and Germany as key demand drivers. The shift toward robot-assisted surgeries is improving surgical precision and implant longevity.

Spinal Implants: The spinal segment is rapidly growing due to the rising incidence of degenerative spinal disorders and trauma cases. The market embraces motion-preserving technologies like dynamic stabilization systems and artificial discs.

Trauma Implants: Fracture fixation using plates, screws, nails, and rods remains a vital area. The focus is on anatomically contoured plates, locking technologies, and polyaxial screw systems that offer better outcomes with fewer complications.

Dental and Maxillofacial Implants: Rising cosmetic awareness and post-trauma reconstruction needs are driving the adoption of zirconia and titanium-based implants. Innovations in computer-guided implantology are enhancing precision and reducing surgical trauma.

Competitive Landscape and Strategic Partnerships

Global leaders consolidate their positions through acquisitions, R&D investments, and geographic expansion.

At the same time, regional manufacturers in India, Turkey, and China are entering the international arena with affordable and CE/FDA-certified products. Collaborations with academic institutions and start-ups foster rapid prototyping and faster innovation cycles.

To remain competitive, companies must invest in:

- Surgeon training and education initiatives.

- Postoperative care solutions and digital tracking systems.

- Direct-to-hospital and OEM supply partnerships.

Future Outlook: Sustainability and Smart Implants

The medical implant market also evolves as the healthcare industry moves toward value-based care. The next generation of implants will be more innovative, safer, and sustainable.

Sustainability trends include:

- Use of biodegradable implants that dissolve over time.

- Reduced packaging waste and eco-friendly manufacturing processes.

- Localized production to cut carbon emissions from logistics.

Meanwhile, smart implants embedded with sensors will transmit real-time data on load, stress, and healing progress, transforming how postoperative care is delivered.

Conclusion

The global surgical implant market presents a rare convergence of clinical necessity and technological potential. Despite the hurdles of cost, regulation, and competition, the path forward is marked by innovation and expansion. As companies align their strategies with local needs and global standards, they will play a defining role in enhancing mobility, independence, and quality of life for millions worldwide.